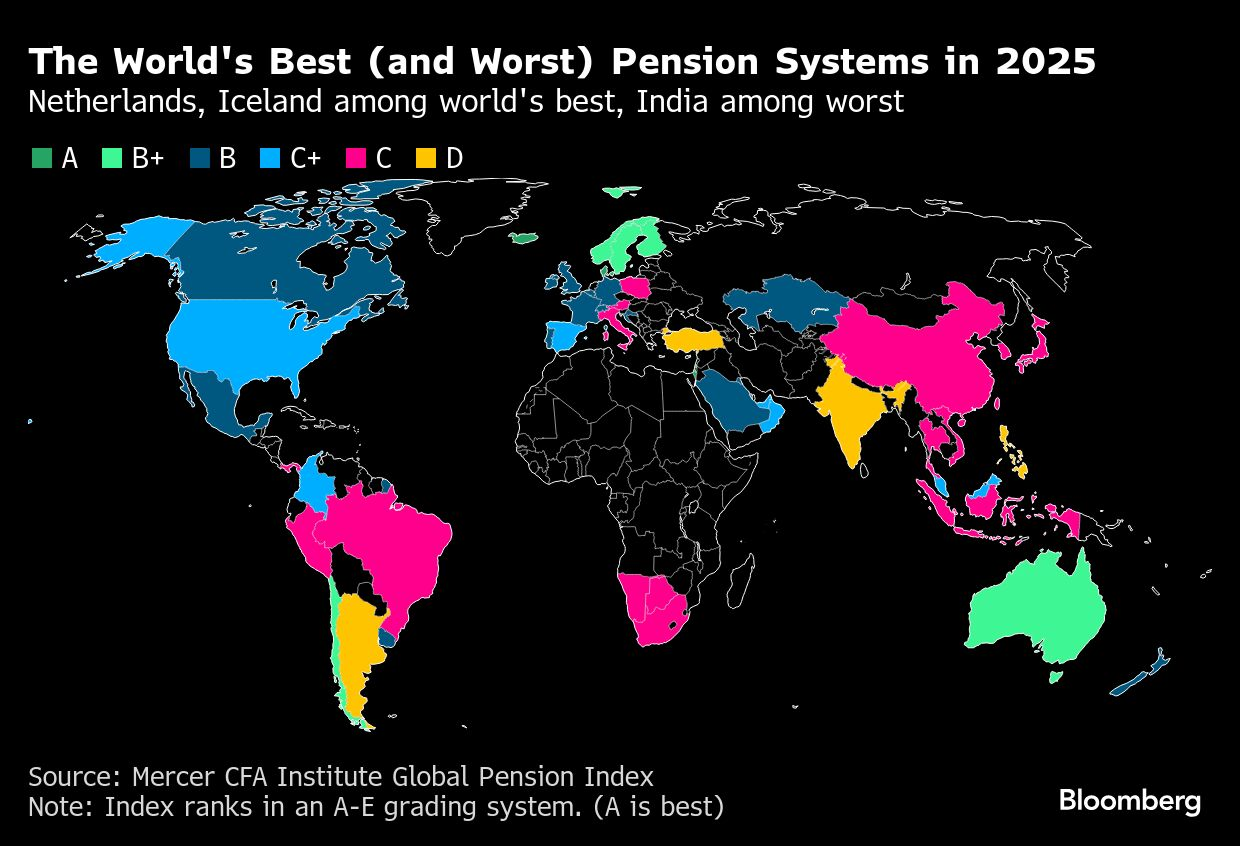

India has recorded the lowest position in the 2025 Mercer CFA Institute Global Pension Index (MCGPI), receiving a D-grade for its pension system. The ranking highlights serious weaknesses in India’s retirement and social security framework, demanding urgent policy reforms to improve financial protection for future retirees. The Global Pension Index 2025, evaluated 52 countries based on the adequacy, sustainability, and integrity of their pension systems. India ranked last, falling behind nations such as Philippines, and Argentina. In contrast, Singapore, Israel, Iceland, Denmark and the Netherlands emerged as the top performers with strong, sustainable, and transparent pension structures that ensure long-term financial stability for their ageing populations.

Global Pension System Evaluation and Country Rankings: Where Does India Stand?

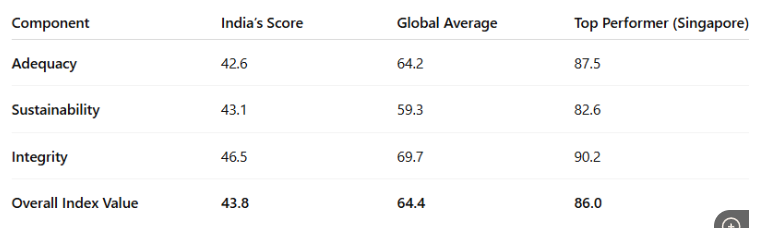

The Global Pension Index 2024 evaluates nations on the basis of three main criteria: integrity, sustainability, and adequacy. Sustainability (35% weight) assesses how long a nation's pension system can continue to be financially stable, while adequacy (40% weight) gauges how much money pensioners receive after leaving the job. Integrity (25% weight) looks at how well the pension system is governed, regulated, and transparent. With a dismal rating of "E," adequacy in India turned out to be the weakest pillar, meaning that the majority of retirees make significantly less than what they require to live on. Long-term financial difficulties were indicated by the sustainability score's "D," whereas integrity which reflects governance and regulation performed marginally better with a "C."

Where India Lags in Pension System Performance and Key Suggestions for Improvement

A larger allocation of financial resources is also necessary to generate better returns. David Knox, Senior Partner at Mercer:

Extending coverage and diversifying investments could double India’s pension assets-to-GDP ratio within a decade, but reforms must balance safety, affordability, and sustainability.

Vivek Iyer, partner and financial services risk advisory leader, Grant Thornton Bhara highlights:

Offering universal social security is something that India cannot afford right now from a fiscal prudence standpoint. However, increased government focus on employment generation, strengthening of regulatory oversight through the Pension Fund Regulatory and Development Authority (PFRDA), and growing investor awareness about retirement planning are all positive developments. Even a country like Singapore took 16 years to move from a C category to the top category. We should therefore view Indian reforms as a continuum rather than a one-time effort, which will gradually deliver meaningful change in the coming years.

To meet global pension system standards, India must prioritise guaranteeing a minimum pension for the elderly, particularly those living below the poverty line. While there are adequate pension policies for the organised and government sectors, greater effort is needed for the unorganised sector, including proper implementation of retirement-age policies and ensuring transparency to avoid delays and irregularities in pension disbursement.