InterGlobe Aviation Limited, IndiGo Airlines announced its results for the September Quarter on November 4, reporting a net loss of ₹2,582 crore in Q2 due to rising costs and forex losses. The decline is largely attributed to increasing foreign exchange losses, even as the airline continued to demonstrate high revenues, strong operational performance and optimized capacity deployment.

About the Revenues

IndiGo, in Q2 that ended on September 30, 2025, reported a 7.8% rise in capacity deployment measured in available seat kilometres (ASKs) to ₹4,120 crore. Total income for the quarter rose by 10.4% to ₹19,600 crore, driven by passenger ticket revenues of ₹15,967 crore (up 11.2%) and ancillary revenues of ₹2,141 crore (up 14.2% year-on-year). Total expenses increased by 18.3% to ₹22,081 crore. Passenger traffic grew by 3.6%, and yield improved by 3.2%, while the load factor remained steady at 82.5%. Fuel cost per available seat kilometre (CASK) fell by 16.3% to ₹1.45, whereas CASK excluding fuel and forex increased by 3.9% to ₹3.01. The airline operated up to 2,244 daily flights, serving 94 domestic and 41 international destinations.

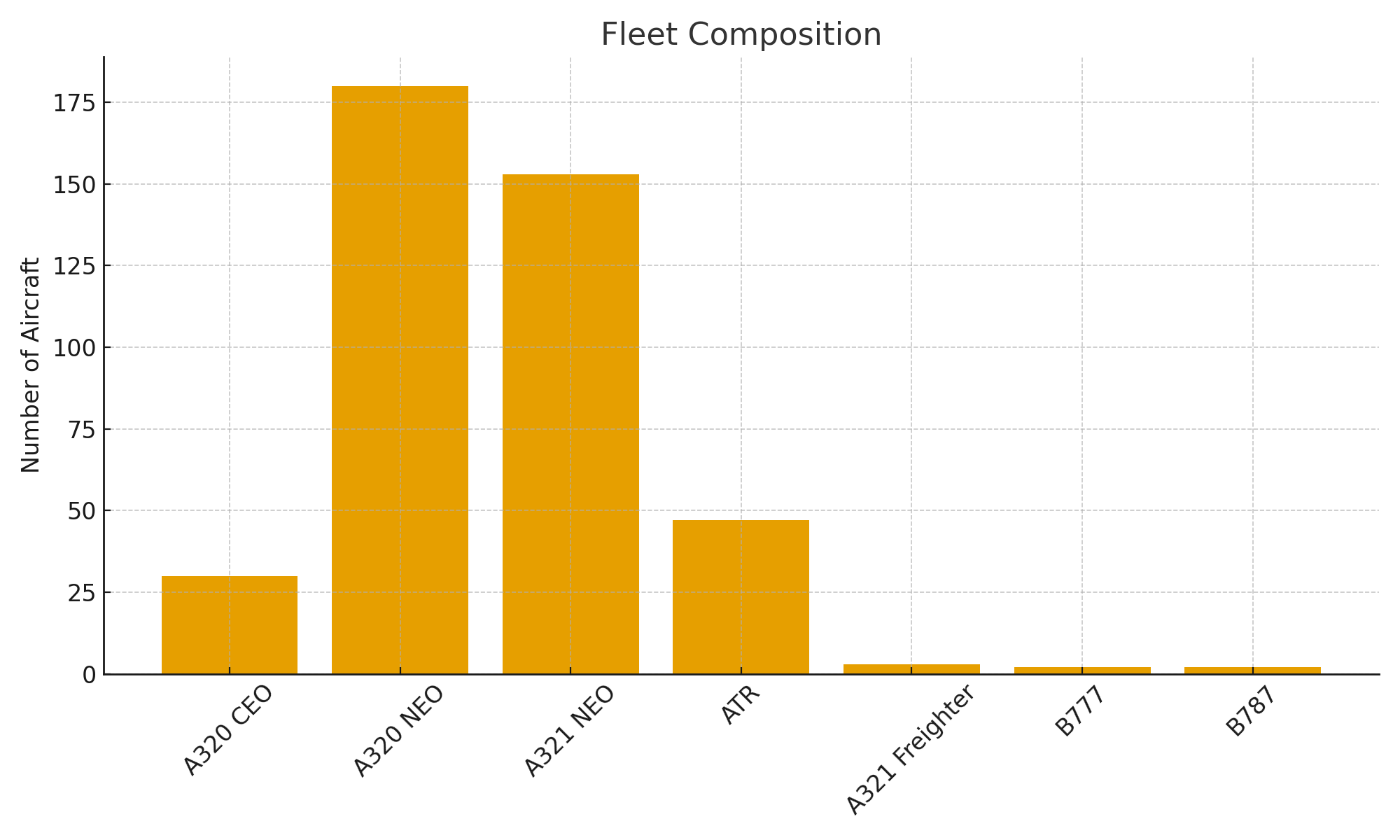

With a net addition of one passenger aircraft during the quarter, IndiGo’s fleet of 417 aircraft consisted of 30 A320 CEOs (including 4 on damp lease), 180 A320 NEOs, 153 A321 NEOs, 47 ATRs, 3 A321 freighters, 2 B777s (damp lease), and 2 B787s (damp lease).

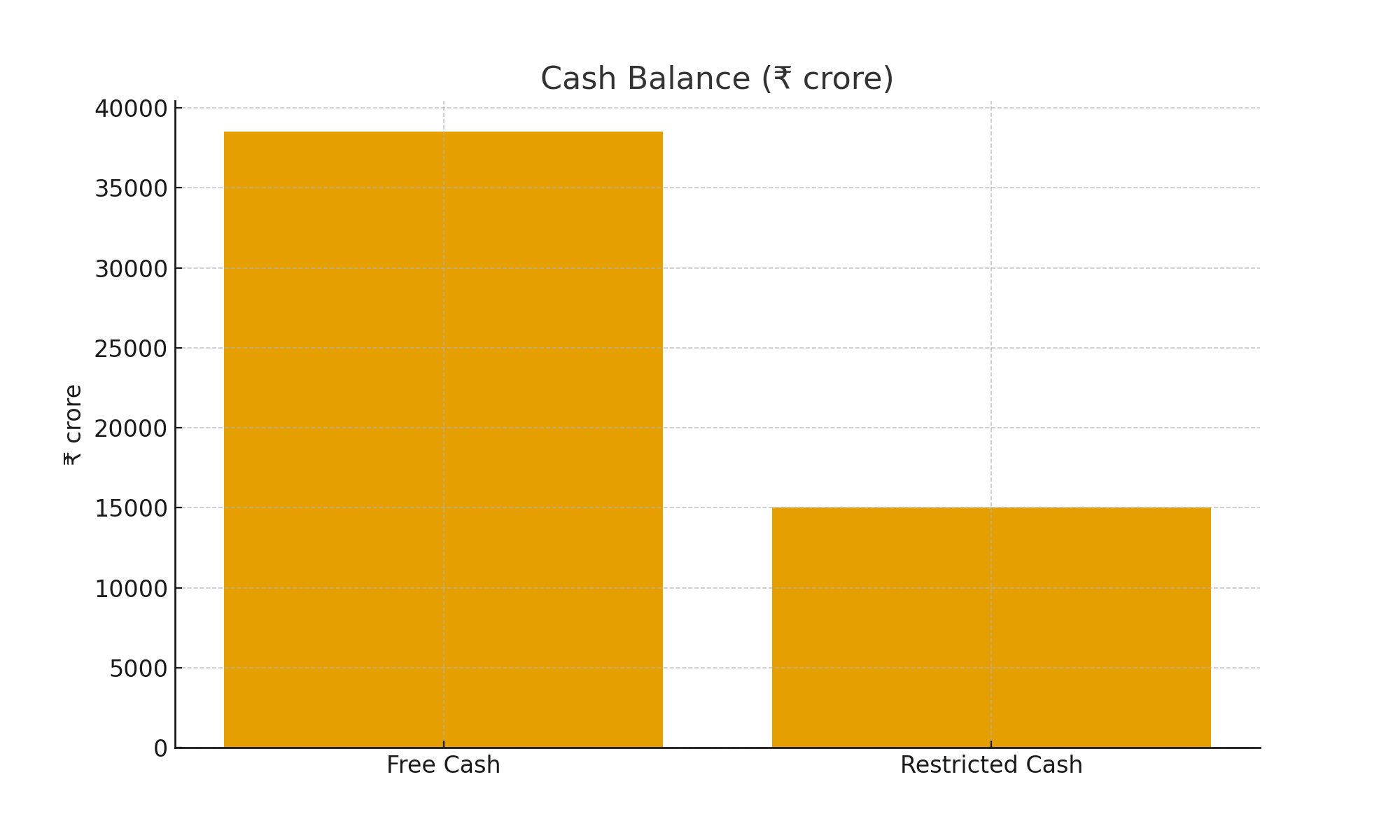

The total cash balance stood at ₹53,515.2 crore, comprising ₹38,516.7 crore of free cash and ₹14,998.5 crore of restricted cash. Total debt, including capitalized operating lease obligations, amounted to ₹74,814 crore, of which ₹49,651.4 crore was capitalized operating lease liability.

Past Trends of IndiGo Revenue

Operational revenue increased from ₹16,969 crore in the same quarter last year to ₹18,555 crore, a 9.3% year-over-year increase. EBITDA, or earnings before interest, tax, depreciation, and amortization, climbed by 85% to ₹3,472 crore from ₹1,873 crore in the previous year. The EBITDA margin increased from 11% to 18.7% in the previous year.

The quarter's tax expenditure was ₹100 crore, up from ₹80 crore during the same period last year. The cost of aircraft maintenance and rentals increased from ₹2,745 crore to ₹3,262 crore in the previous year.

Compared to the ₹241 crore loss registered during the same time previous year, the company reported a forex loss of ₹2,892 crore. The margin improved to 20.5% from 15.7% a year earlier, and EBITDAR excluding forex climbed 43% year over year to ₹3,800 crore.

What does the CEO state on the Net Loss?

Pieter Elbers, CEO of IndiGo Airlines, stated

Looking ahead, we have scaled up our operational plans for the second half to meet demand and continue driving growth. With that, we have nudged up our capacity guidance for the full financial year 2026 to early-teens growth.

Despite the widened net loss in Q2, IndiGo’s consistent operational efficiency, revenue growth, and stable load factors reflect its resilience amid cost pressures. IndiGo Airlines is scaling up operations and expects early-teens capacity growth in FY26 an indication that it will remain focused on long-term expansion even in a challenging cost environment.